DeFi's "Recovery"? Don't Make Me Laugh.

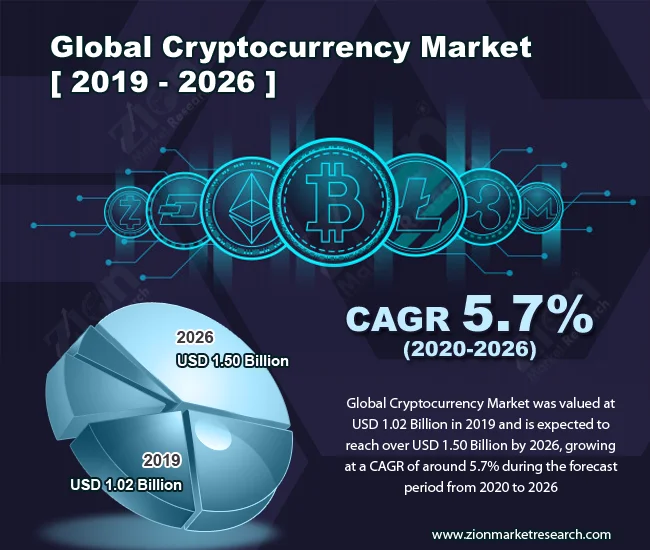

Okay, so we're supposed to believe that DeFi is "recovering" after the October crash? Give me a freakin' break. FalconX is out there peddling this narrative about "nuances" in the market. Nuances? It's down 37% QTD! That ain't a nuance; that's a bloodbath. DeFi Token Performance & Investor Trends Post-October Crash

Questionable Investor Sentiment

Investors are supposedly flocking to "safer" names with buybacks? HYPE and CAKE? Seriously? We're talking about crypto here, people. "Safe" is relative, like saying a rabid chihuahua is "safer" than a great white shark. It's still gonna bite your ankles off.

Dubious "Idiosyncratic Catalysts"

And this whole "idiosyncratic catalysts" crap... Morpho and Syrup outperformed because of "minimal impact from the Stream finance collapse"? How is that a reason to invest? It's like saying you're buying stock in a toilet paper company because their competitors had a warehouse fire.

The Multiple Mess: Who's Getting Rich Off This?

Then comes the multiples game. Spot and perpetual DEXes are "cheapening" because their prices dropped faster than their activity? No freakin' duh! That's how markets WORK. Are we supposed to be impressed that some DEXes, like CRV, RUNE, and CAKE, posted greater 30-day fees compared to September? Okay, great. They’re making slightly more money while the whole sector is circling the drain. Whoop-dee-doo.

Lending and Yield: A False Sense of Security

Lending and yield names are "steepening" on a multiples basis because price declined less than fees? KMNO's market cap fell 13%, while fees declined 34%? So, it's LESS bad than other sectors? That's the bullish case? Gimme a break.

Oh, and investors are "crowding" into lending names because it's seen as "stickier" than trading? Stickier like flypaper. You’re still gonna get stuck. And what happens when those stablecoin yields dry up? Everyone runs for the exits.

I swear, these "analysts" live in a different reality. They’re probably the same guys who told us FTX was a solid investment.

(Tangent: Speaking of analysts, my internet bill just went up AGAIN. These freakin' ISPs are robbing us blind. Where's the decentralized internet, huh? Where's the disruption?)

Solana: The "Efficient" Savior? More Like Efficiently Overhyped.

Okay, so Solana's still kicking around, huh? "High throughput and low transaction costs"? Sounds great on paper. But let's be real, it's just another cog in the machine, another playground for NFT degens and DeFi dreamers who think they're gonna get rich quick.

Questionable Transaction Volume

"Consistently achieves 1,000+ transactions per second"? Cool story. But how many of those transactions are actually useful? How many are just bots and wash trades jacking up the numbers?

Overrated Speed and Scalability

And the whole PoH + PoS thing... "Confirms transactions in less than 400 milliseconds"? So what? My microwave heats up a burrito faster. Does that make it a good investment?

"Scales for sudden spikes in demand, such as major NFT drops"? Yeah, and then the whole freakin' network grinds to a halt. Efficient, my ass.

The Illusion of Utility

Plus, let's not forget the tokenomics. "SOL functions primarily as a utility token for transaction fees and staking, not as a speculative instrument alone"? Oh, please. Let's be real, it's ALL speculation. The "utility" is just a fancy excuse to pump the price.

Centralization Concerns

And the validator concentration issue? "Geographically diverse but concentrated in regions with strong data-center infrastructure"? Translation: centralized as hell.

Then again, maybe I'm the crazy one here. Maybe I'm just too cynical. Maybe everyone else is seeing something I'm not. But I doubt it.

So, What's the Real Story?

Here's the truth: DeFi ain't "recovering." It's just rearranging the deck chairs on the Titanic. The whole sector is built on hype, speculation, and unsustainable yields. The October crash exposed the rot, and no amount of "nuance" is gonna change that. It's a house of cards, and it's only a matter of time before it collapses again.