DeFi's October Crash Hangover: Bargain Hunting or Catching Knives?

The DeFi sector is still feeling the chill from October’s crypto crash. FalconX’s report paints a bleak picture: as of late November 2025, only two out of 23 leading DeFi tokens are in the green year-to-date. The group’s down an average of 37% quarter-to-date. That’s a bloodbath by any standard. The question is, are these fire-sale prices, or are we watching a slow-motion implosion?

Digging into the DeFi Data

The report highlights a flight to safety, with investors favoring tokens with buyback programs (like HYPE and CAKE) or those with specific, positive catalysts (MORPHO and SYRUP). It's a classic risk-off move. Investors are pulling back from the speculative froth and looking for something resembling fundamental value. The buyback angle is interesting; it suggests a belief, at least from the token issuers, that their assets are undervalued. But let's be real: buybacks are often a desperate attempt to prop up a flagging price. (Think of it as financial engineering with digital assets.)

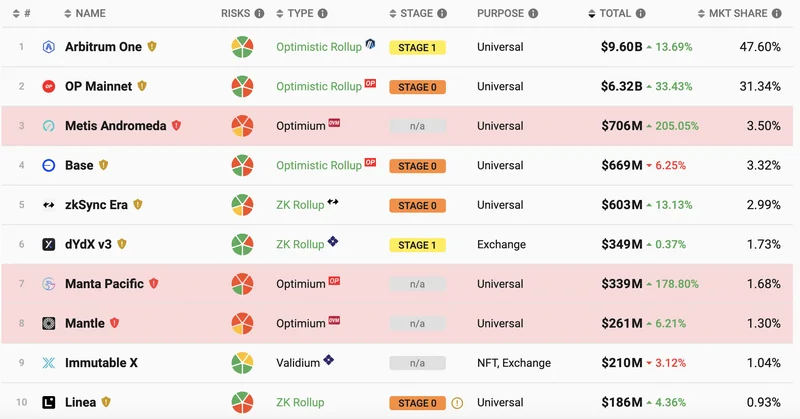

Shifting Valuation Landscape of DEXs

The shifting valuation landscape is equally telling. Spot and perpetual decentralized exchanges (DEXs) have seen price-to-sales multiples compress as prices declined faster than protocol activity. Some DEXs, like CRV, RUNE, and CAKE, actually posted greater 30-day fees in November compared to September – a notable discrepancy. It suggests that while the overall market is down, these specific platforms are still generating revenue. Is this a sign of resilience, or simply a lagging indicator before those fees dry up too?

Lending Sector Performance

The lending sector is another area to watch. Lending and yield-related tokens have broadly steepened on a multiples basis (market cap fell 13% while fees declined 34%). Investors might be crowding into lending names, viewing them as "stickier" than trading activity during a downturn. The logic is sound enough – people still need to borrow and lend even when the market is tanking, and those who exited to stablecoins might seek yield opportunities. But it's a crowded trade, and crowded trades have a habit of unwinding spectacularly.

Crypto Predictions and New Coins: A High-Wire Act

Elsewhere, forecasts for 2025 are directionally bullish. Bitcoin is projected to trade between $80,440 and $151,200, with a stretched target up to $185,000. Ethereum is expected to range from $1,667 to $4,495, with a possible push to $5,190. Solana could see $121 to $495, with a stretched target of $590. XRP? $1.80 to $4.14, potentially $5.25. Binance Coin, $582 to $970. Cardano, $0.56 to $1.81. And so on. These predictions are highlighted in a report on 15 Cryptocurrency Forecasts For 2025 (Updated).

The Reality of Crypto Predictions

These are wide ranges, to say the least. You could drive a truck through those spreads. They're less predictions and more… educated guesses.

New Coins Entering the Market

Then there’s the flood of new coins hitting the market. Coinspeaker highlights Bitcoin Hyper (HYPER), Maxi Doge (MAXI), and PEPENODE (PEPENODE) as top picks for December 2025. HYPER, a Bitcoin Layer 2 solution, has seen significant staking (1.3 billion+ tokens). Maxi Doge is targeting the "degen" trading crowd. And PEPENODE is offering a virtual mining rig.

Concerns About New Coin Sustainability

I've looked at hundreds of these filings, and the staking APY on PEPENODE feels unsustainable. The delta-neutral model works until derivatives markets dry up or funding rates flip negative, then the whole thing breaks.

Market Balancing Act

These new coins are being launched into a market balancing recent volatility with long-term potential. Presales are evolving into structured investments. Layer 2 scaling and DeFi expansion provide the foundation.

The Verdict: Proceed with Extreme Caution

So, what’s the takeaway? Is this a buying opportunity, or are we watching the DeFi sector bleed out? The data suggests a mixed bag. Some protocols are showing resilience, generating fees even in a down market. Others are relying on financial engineering (buybacks) or crowded trades (lending) to stay afloat. And the flood of new coins, while potentially innovative, adds another layer of risk.

The Importance of Due Diligence

The key, as always, is due diligence. Don’t blindly chase the hype. Look at the underlying fundamentals. Are these protocols generating real revenue? Are they solving a real problem? And most importantly, are their valuations justified by their performance?

October Crash: A Wake-Up Call

I'd say the October crash was a wake-up call. The DeFi sector is not immune to market forces. It's still a nascent industry, full of risk and uncertainty. There are opportunities to be sure, but they require a sharp eye and a healthy dose of skepticism.

Bargain Basement or Burning Building?

The DeFi sector is at a crossroads. It could rebound and reach new heights, or it could fade into irrelevance. The numbers don't lie: the October crash has left a mark. It's up to investors to decide whether to bet on a recovery or cut their losses and move on.