DeFi's Second Wind: How Innovation Is Priming Crypto for a Bull Run in 2025

Okay, folks, buckle up. I've been poring over the data, and I'm seeing something truly exciting in the DeFi space. Remember the crypto crash of late '25? The one that felt like a gut punch to anyone who believed in decentralized finance? Well, the dust is settling, and what's emerging is not a wasteland, but a fertile ground for innovation and a potential launchpad for a bull run.

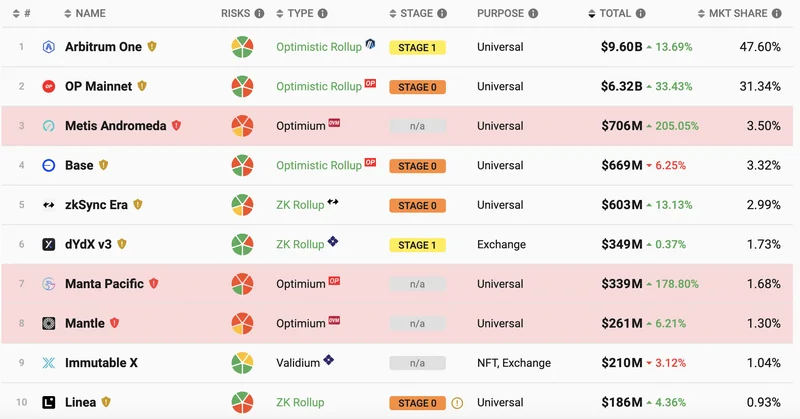

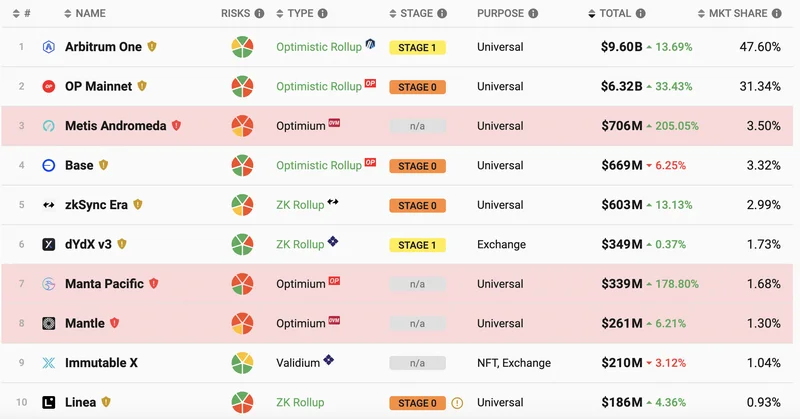

The Flight to Quality in DeFi

The initial reports coming out of FalconX paint a stark picture: most DeFi tokens are still struggling year-to-date. But here’s the thing – averages can be deceiving. Averages hide the diamonds in the rough, the projects that are not just surviving, but thriving by adapting and offering real value. We're seeing investors flocking to what I'd call "DeFi 2.0"—safer, more sustainable projects. Think tokens with buyback mechanisms, like HYPE and CAKE, or those with unique catalysts that shield them from sector-wide meltdowns, like MORPHO and SYRUP. What we're seeing here is a flight to quality, a sign that the market is maturing and becoming more discerning. It's like the early days of the internet bubble bursting; the Pets.coms died, but Amazon emerged stronger than ever.

The Smart Money Is Moving

This isn't just about investors chasing returns; it's about them recognizing real potential. As the IndexBox Market Intelligence Platform highlights, certain DeFi subsectors are becoming more attractive, with decentralized exchanges (DEXs) showing compressed price-to-sales multiples. This means you’re getting more bang for your buck, that you can get in on the ground floor of something that is about to explode. And while some lending platforms are seeing their fees decline, investors are piling in—why? Because lending and yield-related activities are stickier, more reliable. People are seeking a safe harbor in the storm, and DeFi lending, done right, offers that.

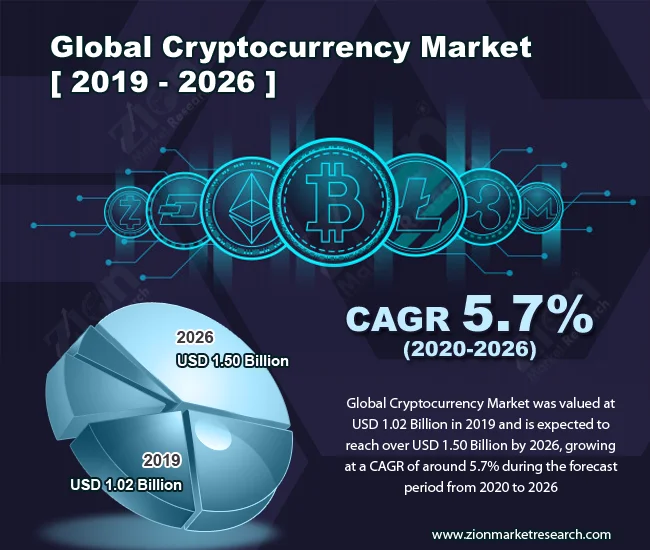

Bullish Crypto Forecasts for 2025

Now, let's zoom out for a second. We're heading into 2025, and the broader crypto forecasts are directionally bullish, and that’s according to 15 Cryptocurrency Forecasts For 2025 (Updated). Bitcoin is projected to potentially hit $151,200—maybe even $185,000! Ethereum? Potentially soaring to almost $4,500 or even $5,190. And what happens when Bitcoin and Ethereum rally? History shows us that profits rotate into altcoins. So, if DeFi projects are already showing signs of strength and resilience, imagine what will happen when the big boys start pumping. It’s like a rising tide lifting all boats, and the DeFi boats that have already patched their holes and reinforced their hulls are going to rise the highest.

Innovation and New DeFi Solutions

But let's not get carried away. This isn't about blind optimism; it's about strategic foresight. We need to look at which tokens are actually delivering. Which ones are innovating? Which ones are building sustainable models? Which ones are fostering strong communities?

Take a look at the new coins that Coinspeaker is looking at, like Bitcoin Hyper – a Layer 2 solution built on Solana that aims to fix Bitcoin’s speed and fee limitations. It’s still speculative, sure, but the fact that it is drawing so much demand is telling. It shows that people are hungry for solutions that bridge the gap between Bitcoin’s security and DeFi’s potential. Or PEPENODE, which aims to add a mine-to-earn utility to meme coins. It sounds crazy, I know, but it also sounds like something that could catch fire if they can deliver on the promise.

Institutional Investment in Ethereum

And then there’s Ethereum, which is seeing some considerable whale buys. The wallet labeled #66kETHBorrow added almost 8,000 ETH! And BitMine treasury wallets acquired over 54,000 ETH! This is institutional money flowing into Ethereum, a clear sign that the smart money is betting on its long-term potential. This is the kind of thing that reminds me why I got into this field in the first place: the potential to reshape finance for the better.

Ethical Considerations in DeFi

Now, I do have to inject a moment of ethical consideration here, as well. It’s important to remember that with any financial innovation, especially in the crypto space, there are risks. We need to be aware of the potential for scams, for manipulation, and for unintended consequences. We have a responsibility to educate ourselves, to be critical, and to advocate for responsible regulation. The power to build a better financial system comes with the responsibility to do it ethically.

The DeFi Renaissance Is Coming

So, what does this all mean? It means that DeFi isn't dead. It's evolving. It's learning from its mistakes. It's becoming more resilient, more sustainable, and more attractive to both retail and institutional investors. We're on the cusp of a DeFi renaissance, a new era where decentralized finance isn't just a buzzword, but a real, viable alternative to the traditional financial system.

What if DeFi can truly unlock financial freedom for billions of people around the world? What if it can empower individuals, small businesses, and communities to build a better future? What if it can create a more transparent, more equitable, and more efficient financial system? I think it can. I truly do. And that’s why I’m so excited about what’s coming.